Feature Scaling

It is always useful to visualize and explore the data

before performing any modeling. We combine the exploration

and data scaling in this section. Scaling is very important

for many machine learning algorithms, so we will scale all

of our continuous variables. We focus the scaling analysis

on the data we trained our models on, to avoid biasing test

results.

I focus in this section primarily on the distributions of the features,

rather than correlation or scatter plots between trends. Quote information

is incredibly noisy, and attempts at these lead to one of two things:

either plots showing little to no correlation due to daily noise, or

apparent high correlation, as the market is always tending towards an

overall increase, and all trends point this way. We will save examination

of trends for the analysis section.

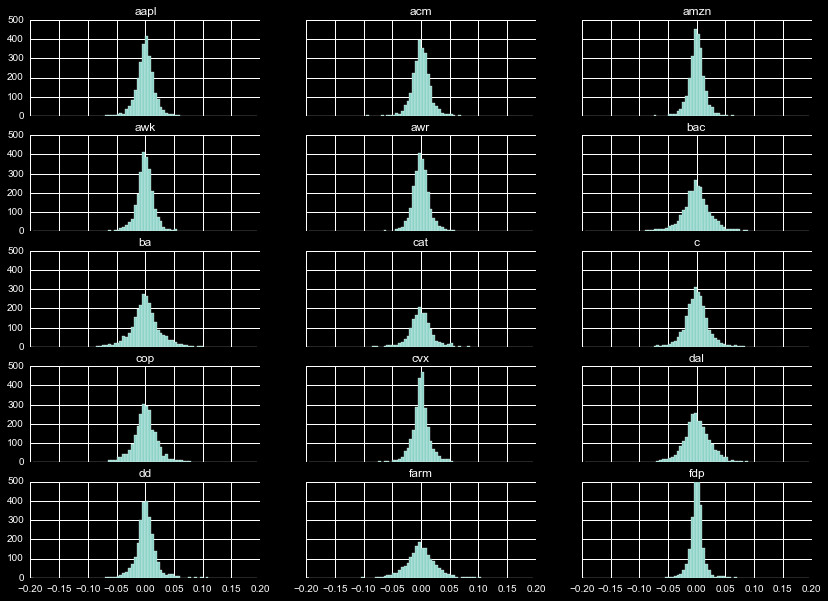

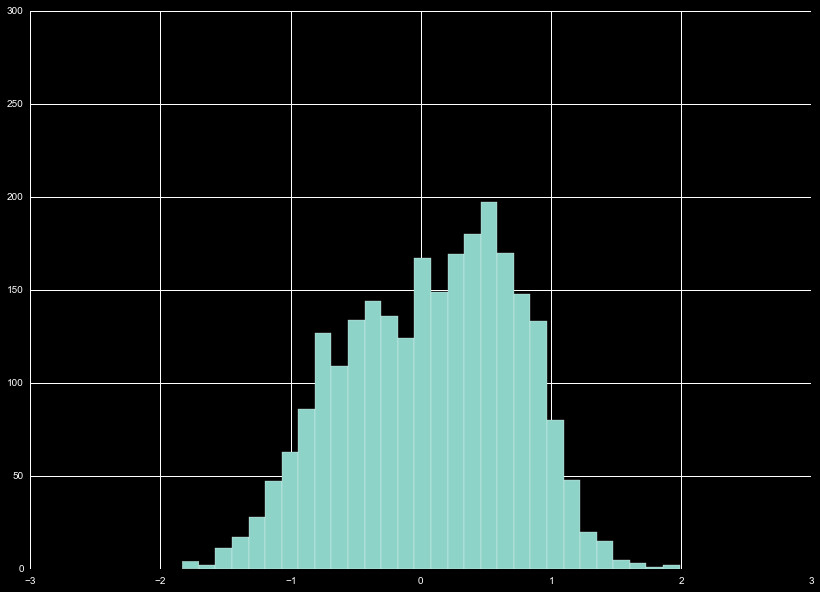

diff_co

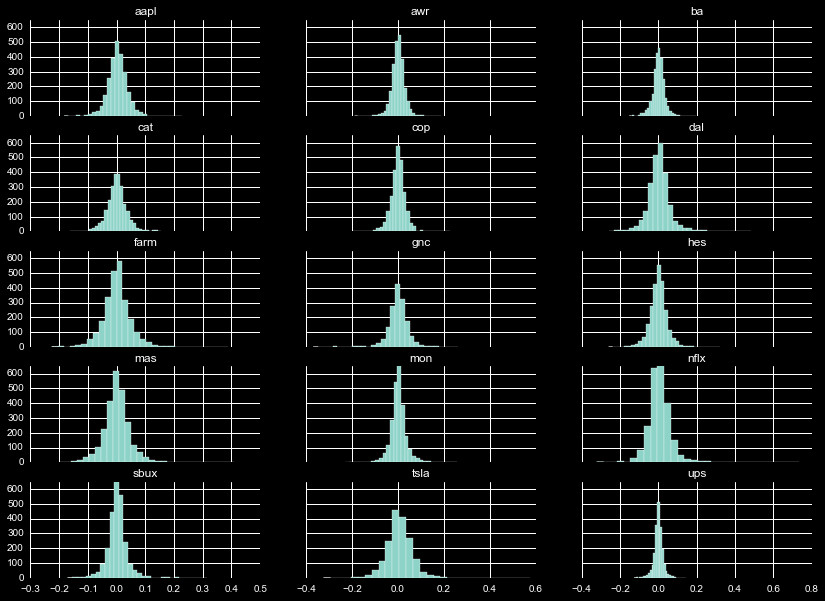

We will start with the percent difference between the closing and

opening price for the day, denoted diff_co. We display the histogram

of this distribution in Figure 1. Examining a few cases, we see

FDP is almost entirely contained within ± 5%, whereas BA is

spread to within a ± 10% range.

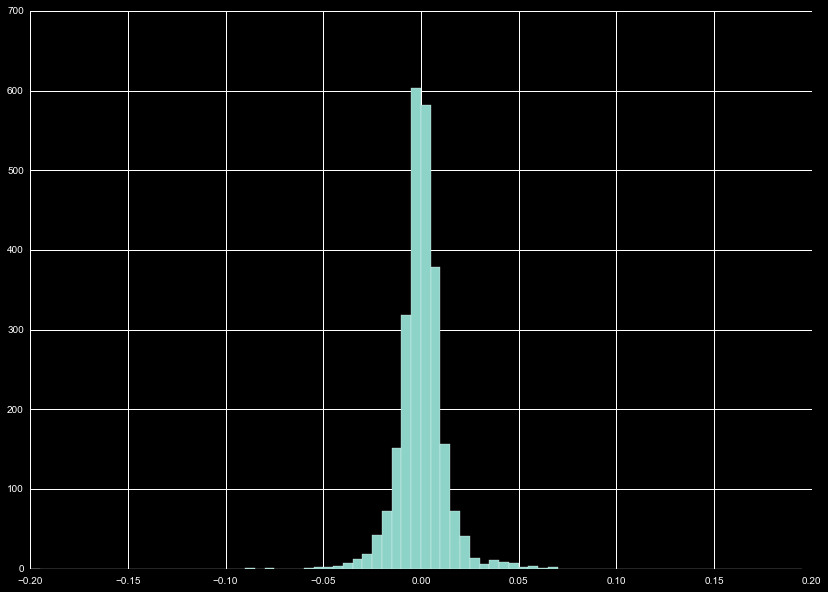

With all these different distributions, it is useful to look at the

combination of these distribution, as we do in Figure 2. We wind up with

a normal distribution, with the bulk of the distribution falling within

that ± 5%.

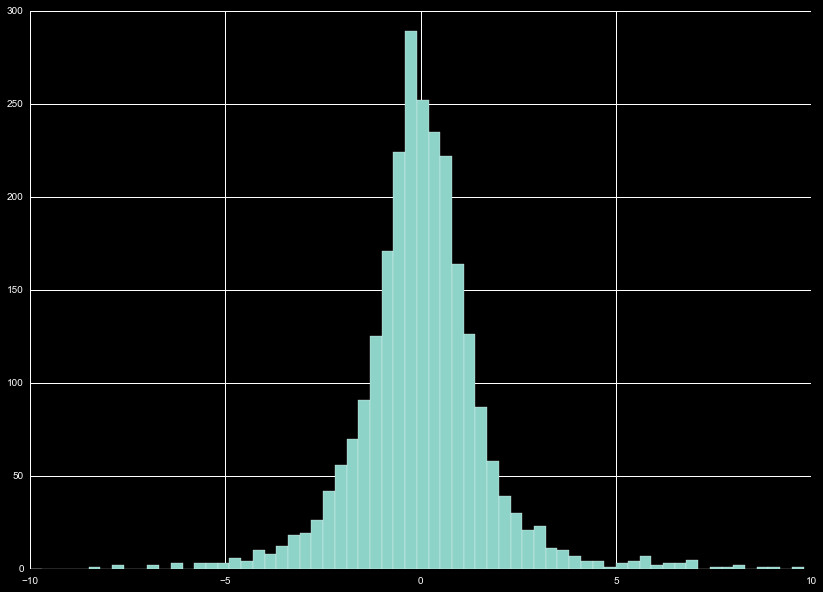

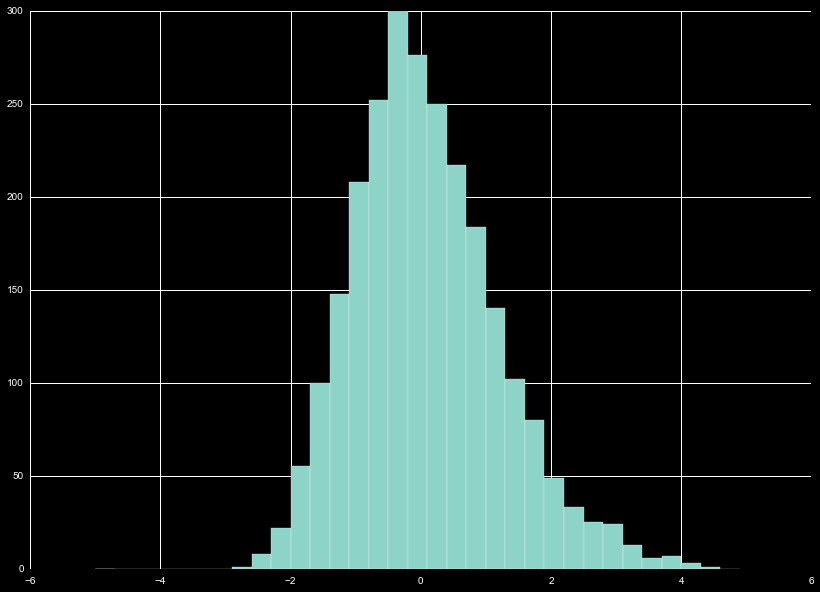

The distribution of all the diff_co values show a clear normal

distribution. We perform a z-scaling on the normally distributed

data, as seen in Figure 3. The scaling performed is a custom scheme,

where we omit data points on the furthest extreme, and renormalize.

This is repeated until the new fits perform minimal change in the

distribution.

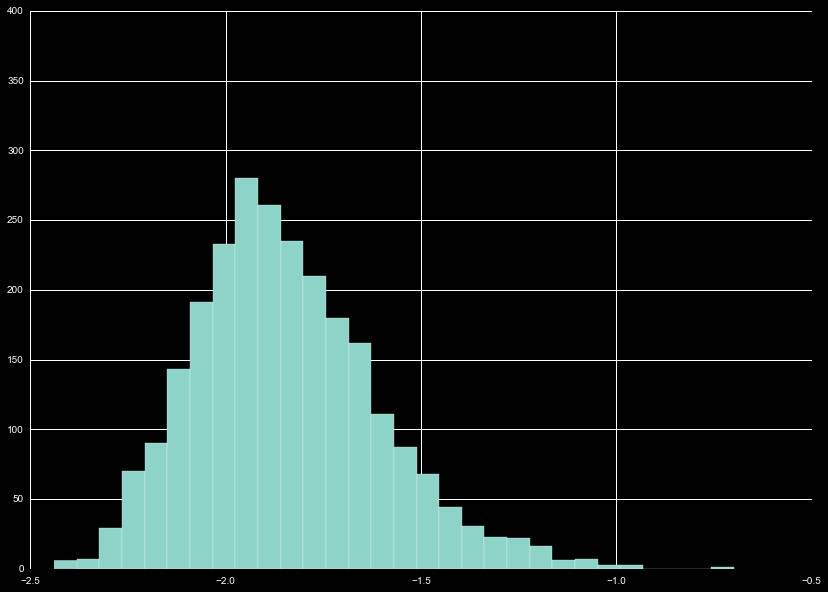

diff_hl

Similar to the analysis we performed for the difference between

close and opening prices, we generated a feature for the percent

difference between daily high and lows, diff_hl. The distribution of

values is exclusively negative by design, and skewed towards higher

diff_hl, as can be seen in Figure 4. We perform z-scaling

on the diff_hl, as can be seen in Figure 5.

Momentum

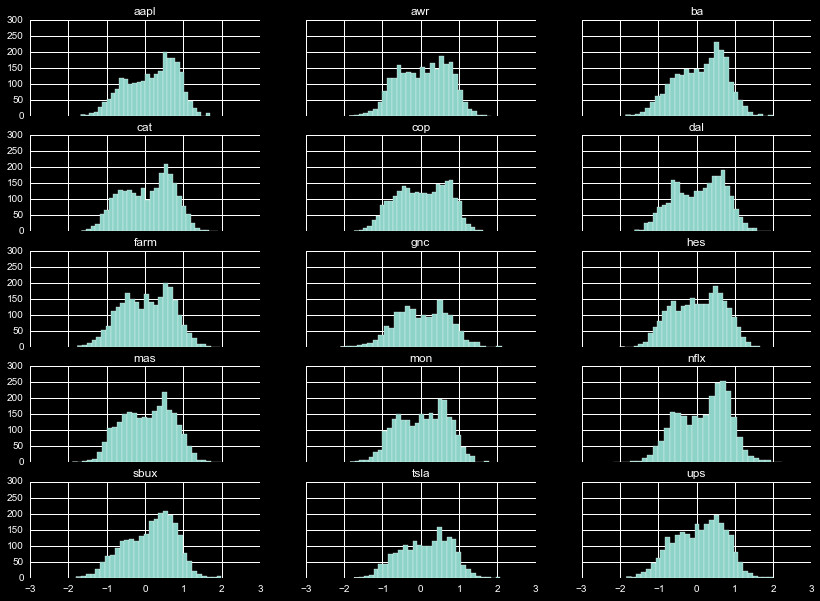

The distribution of momentum, as with diff_co and diff_hl, varies greatly

depending on the company. This can be seen in Figure 6, which shows the

3 day momentum of the percentage of the closing price (arguably the shortest

possible momentum measurement).

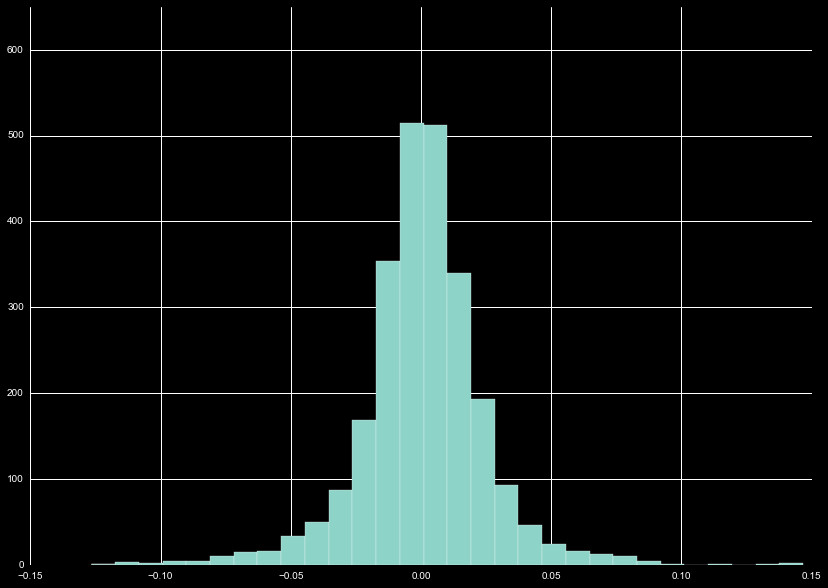

Again, we combine the momentum distributions (Figure 7) before z-scaling the data.

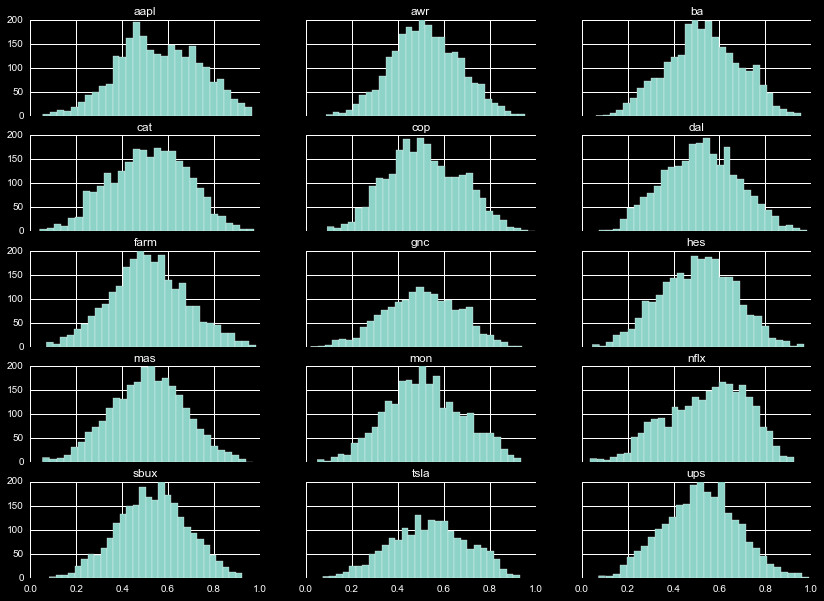

Bollinger Bands

The Bollinger Bands have a unique distribution. Figure 8 shows the distribution of

the daily value relative to the 25 day mean bands. A value of 1 (-1) indicates the

daily close is at the upper (lower) band. As can be seen, there is typically a double

peak in the distribution, with significant variation in the shape of those peaks.

Combining these distributions, we see our first significantly non-normal

distribution in Figure 9. We decide to use a unique scaling for the Bollinger

Bands, with uniform treatment for all band windows we utilize. We z-scale using

a mean of 0, and standard deviation of 0.65 across all bands we choose. This

was selected by calculating the standard deviation for the distribution, and modulating

the scaling value so roughly 95% of the data was within 2 standard deviations.

A non-traditional z-scaling, but more than sufficient to fill our scaling needs.

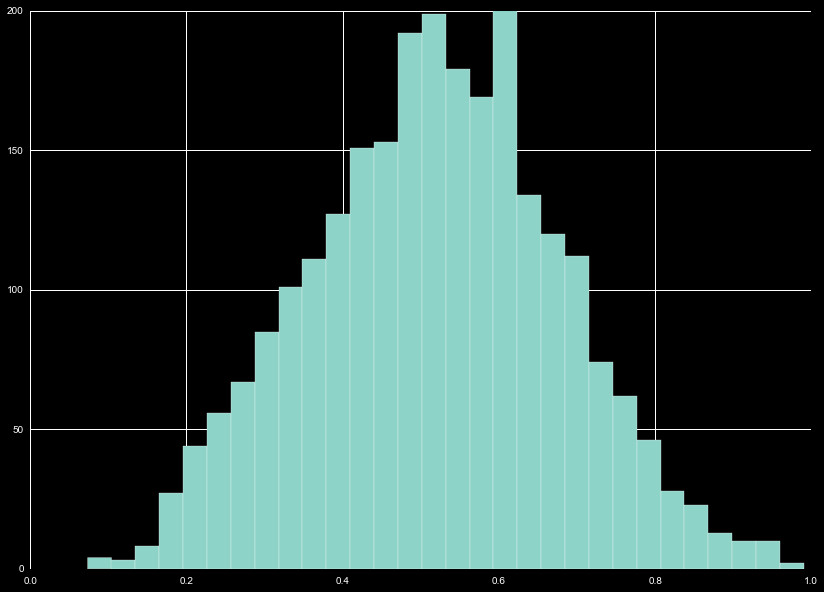

Relative Strength Index

The Relative Strength Index gives a measure of the total gains in the closing

price, relative to the total losses in the closing price, over a window of time.

The simple mathematical form of this is

RSI = 1 - 1 / ( 1 + A / B )

Where A = average gains in window, and B = average losses in window. Due to the

nature of this definition, there is a hard cutoff at 0 and 1, with values typically

winding up around 0.5. We show a 15 day RSI in Figure 10 (typically 14 days is used).

We combine the distributions in Figure 11, and the cumulative distribution almost

resembles a normal distribution.

Like the Bollinger Bands, this requires a unique normalization. We could perform

a min-max normalization, bringing the distribution from -1 to 1, but given the

shape of the distribution it seems appropriate to perform another custom z-scaling.

Fitting 95% in two sigma, we use a mean of 0.5 and standard deviation of 0.2 to

z-scale all RSI features.

Log Closing Price

Finally, we perform another custom normalization for the base 10 logarithm

of the closing price. The closing price lies between $10 and $1000 for

almost all common stocks, and for everything in our distribution. This places

the log between 1 and 3, so subtracting 1.5 puts most our log prices between

-1 and 1. With this I play more loosely, as this will most likely serve as

a damping term, where more or less expensive prices lead to steeper or

flatter trends.